Did you hear some weird noises from your car when you’re out driving? Is it not performing as well or the gas mileage has dropped? There’s a good chance that a part has worn out and will need to be replaced. Fortunately, even if it’s a big component, auto parts financing will let you get what you need without requiring a lot of money on hand.

How Does Parts Financing Work?

If you have ever decided to finance a car, you know how auto parts financing works. If you haven’t, it basically involves these steps:

Finding the Right Part

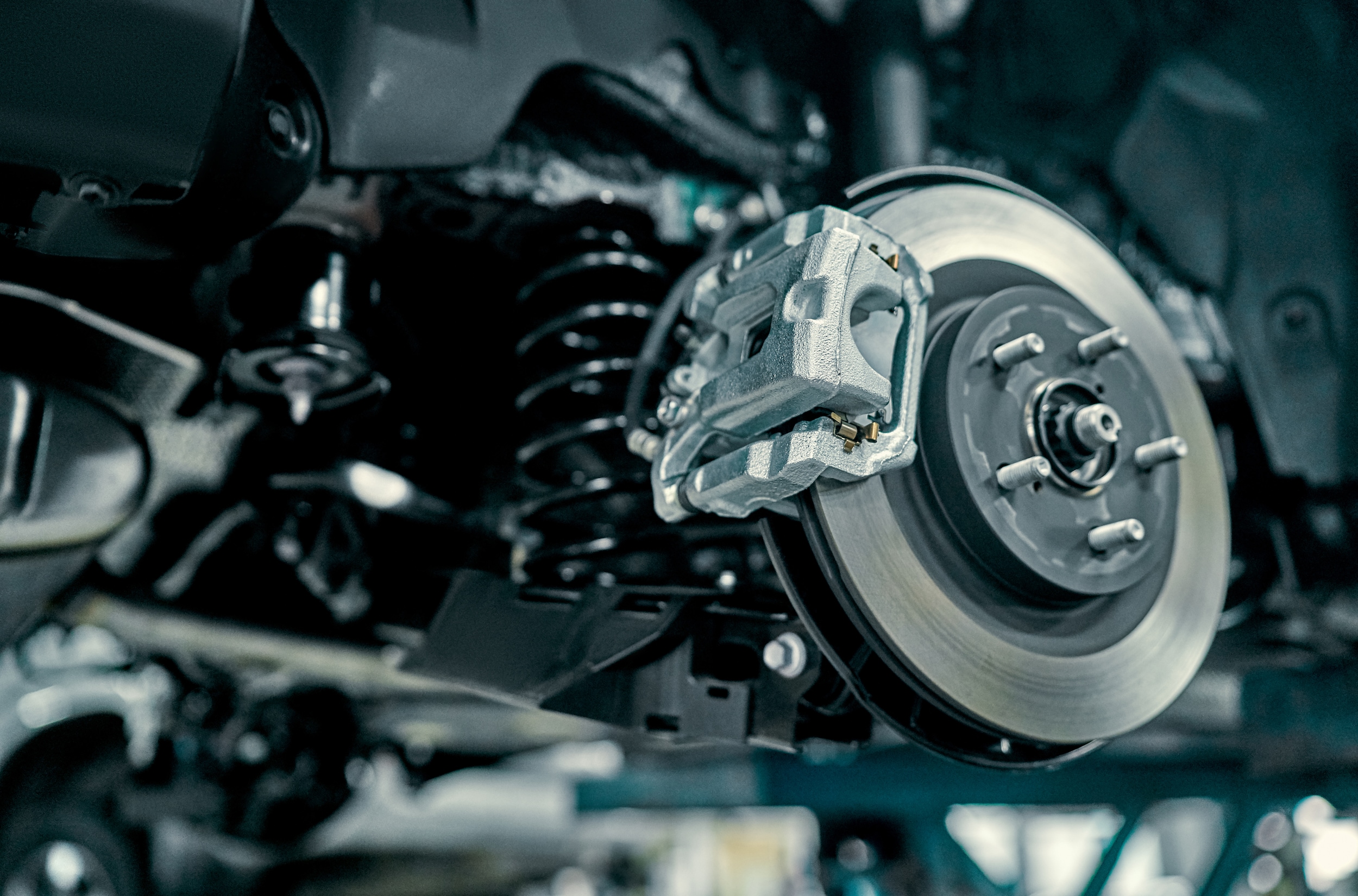

The first thing to do is to figure out which part you need. It’s important to remember that OEM components offer the best performance.

Determining Your Down Payment

While you may not have to put any money down, you should consider this anyway. The more you have upfront, the less you will need to borrow, and the less interest you have to pay.

Borrowing What You Need

The next step is to apply for a loan with a bank or another type of financial institution.

Creating a Payment Plan

Once you know how much you will be borrowing, it’s time to think about what you can afford every month. The longer you have to pay off the loan, the smaller your monthly payments will be.

A. M. Maus & Son Makes Parts Financing Easy

If you are ready to get the financing process started, you can begin by filling out our online application. Once submitted, someone from our Jeep® dealership will get in touch to discuss your options. If you’re not sure which part your vehicle needs, just make an appointment with our service center near St. Cloud to have it looked at by our trained and certified technicians.